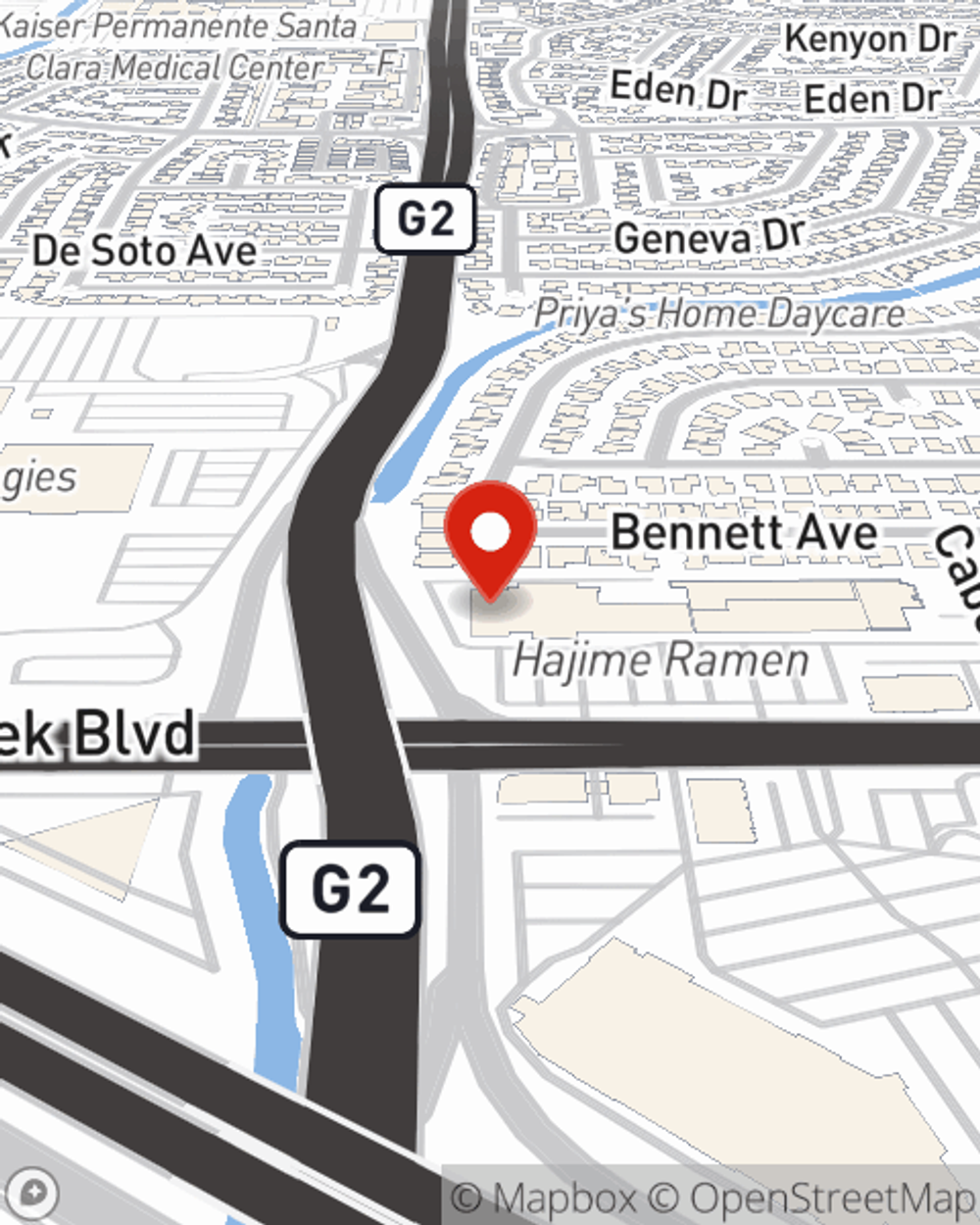

Business Insurance in and around Santa Clara

Looking for small business insurance coverage?

Cover all the bases for your small business

Insure The Business You've Built.

Operating your small business takes time, dedication, and quality insurance. That's why State Farm offers coverage options like extra liability coverage, worker's compensation for your employees, errors and omissions liability, and more!

Looking for small business insurance coverage?

Cover all the bases for your small business

Cover Your Business Assets

Whether you own a HVAC company, a donut shop or a floral shop, State Farm is here to help. Aside from excellent service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Jon Barron today, and let's get down to business.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jon Barron

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.